Calculating tax on a form for QuickBooks

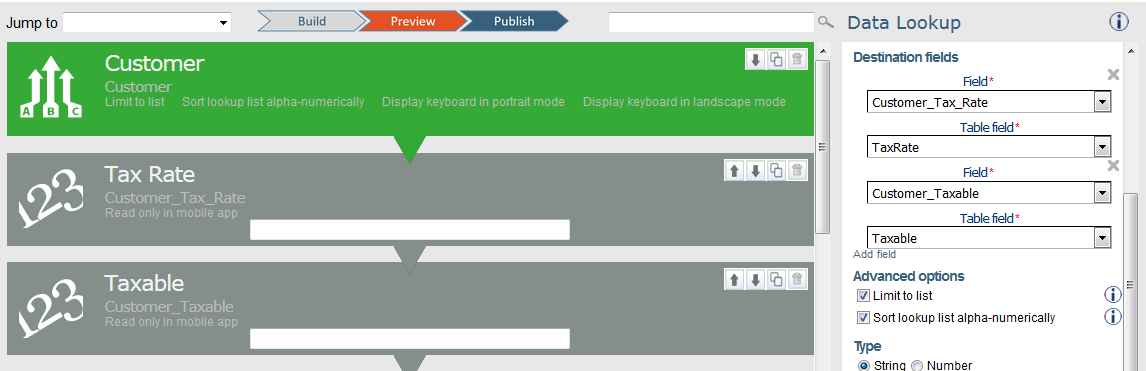

- Upload a lookup table of QuickBooks customers. Make sure the TaxRate and Taxable fields are included.

If the customer is taxable the Taxable field will contain 1, otherwise it will contain 0.

- Include two destination fields on the form for the customer tax rate and the customer taxable fields.

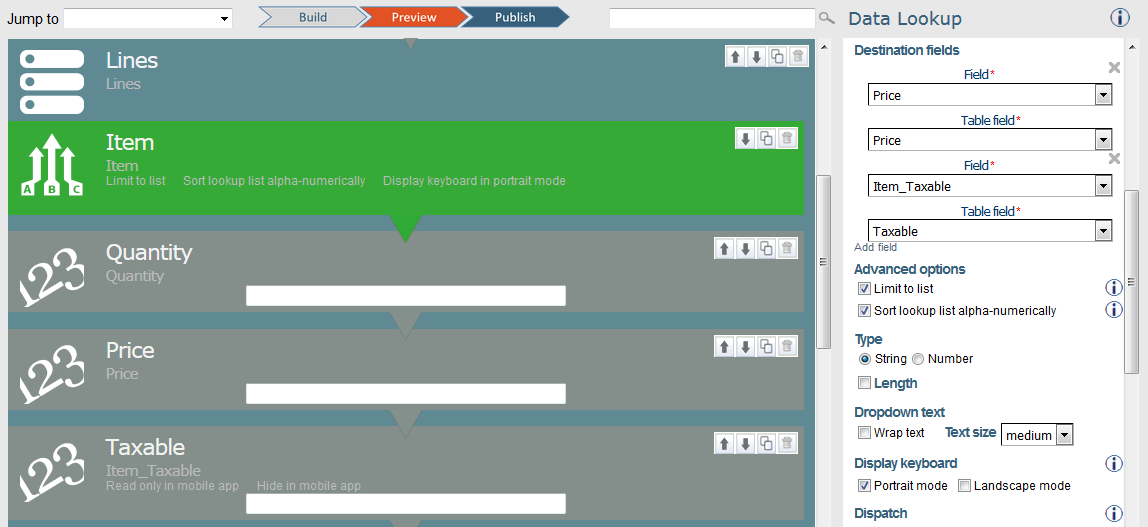

- Upload a lookup table of QuickBooks Items. Make sure the Taxable field is included. If the item is taxable, the Taxable field will contain 1, otherwise it will contain 0.

- Include a destination field on the form for the item taxable field.

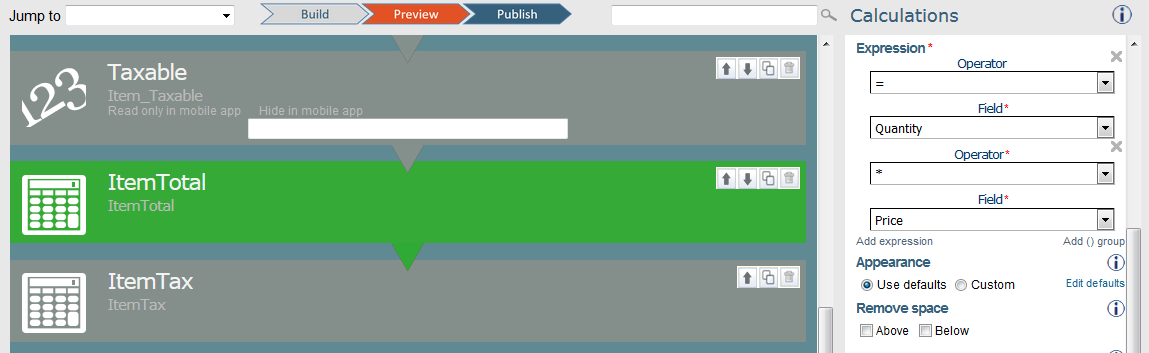

- Add a calculation in the line items Repeatable or Table to calculate the item total: Quantity * Price

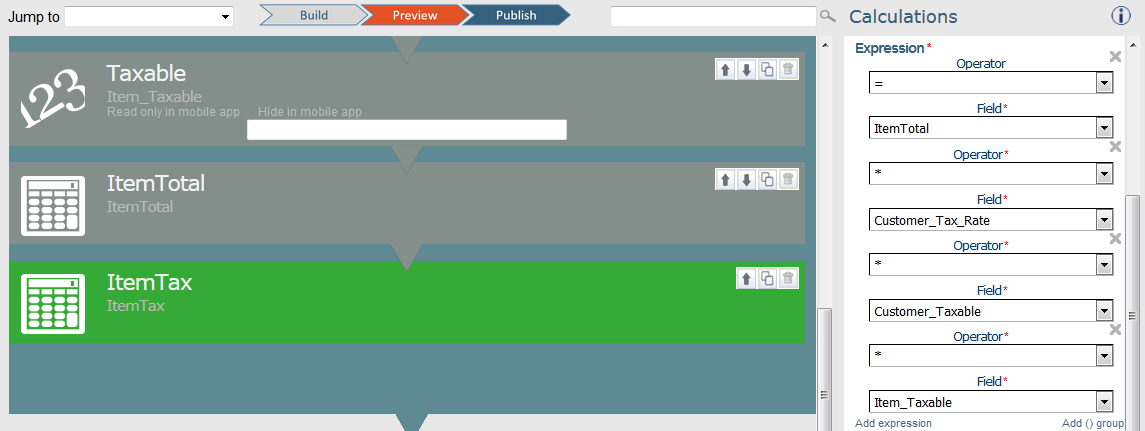

- Add a calculation in the line items Repeatable or Table to calculate the item tax: ItemTotal * Customer_Tax_Rate * Customer_Taxable * Item_Taxable

Note that if either the Customer_Taxable or Item_Taxable is zero, then the ItemTax will be zero.

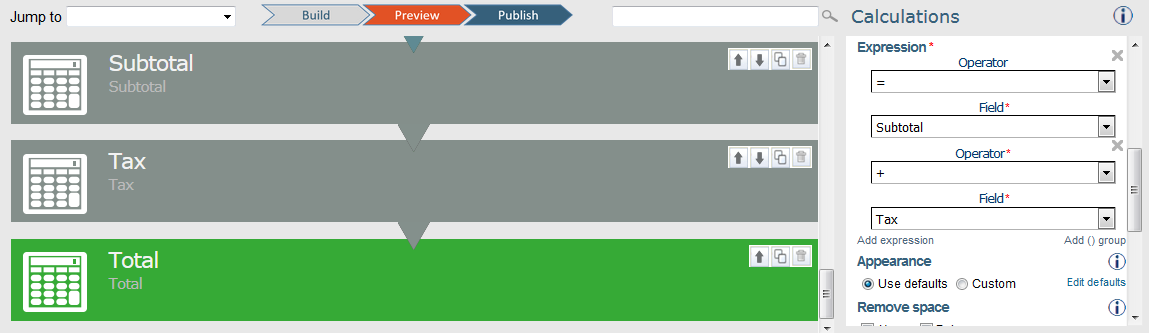

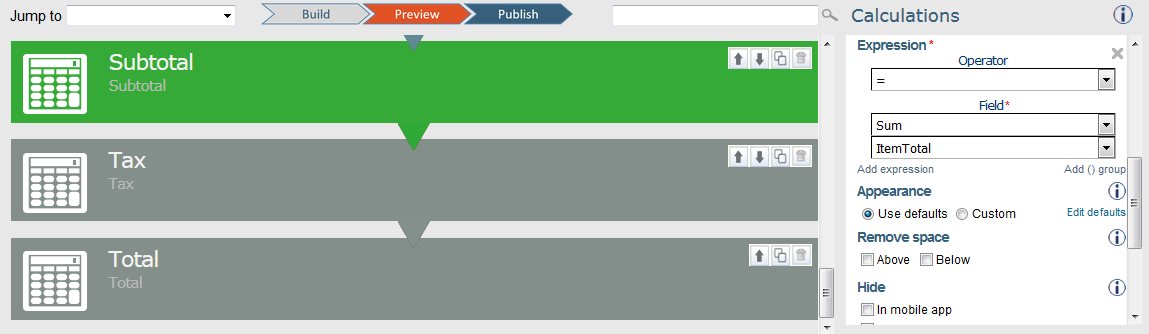

- Add a Subtotal calculation at the end of the form: Sum ( ItemTotal )

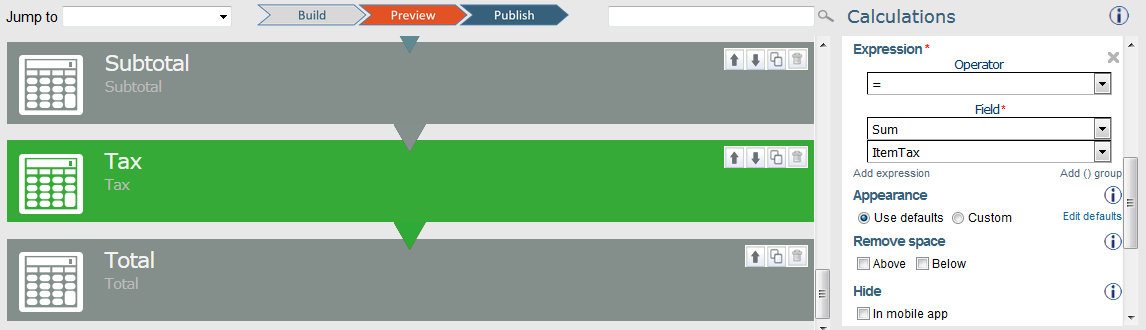

- Add a Tax total calculation: Sum ( ItemTax )

- Add a final Total calculation: Subtotal + Tax